1. You can and should take some time to grieve before taking care of business.

In the days immediately following a devastating loss, it will be tough enough just to plan the funeral and deal with basic logistical issues. Try your best not to worry about anything else. Give yourself a few weeks after the funeral, too, to focus on grieving — whatever that means to you. Of course, grief does not have an expiration date; but within a month of your loss, we urge you to find the resolve to start addressing the residual legal issues that remain after your loved one’s death.

2. Identify and document your loved one’s property and correspondence to avoid potential fraud and theft.

Did your loved one live alone before his death? Leaving the decedent’s residence unattended for a long time presents scary and unique opportunities for thieves. Unopened mail or parcels also invites fraud because a thief can learn a lot by simply opening mail. Secure correspondence, financial records and packages delivered to the residence before they fall into the wrong hands. The only thing worse than grieving a loss would be grieving a loss and dealing with vandalized property, identity theft or squatters (yes, it happens). If the deceased owned a business or rental property, notify creditors/tenants to whom payments should now be made.

3. Don’t “Sign on the Bottom Line.” Refrain from signing any legal documents — even if someone describes them as “routine” — until you have obtained advice from the appropriate professional.

Amid your grief, you may be lulled into signing documents without considering whether there is a choice. But it is often very difficult — and in some cases impossible — to reverse the course of events after you have signed legally significant documents. We encourage you to take the time to meet with the appropriate professionals (lawyers, accountants, financial planners, etc.) who can advise you on the legal and/or financial implications of what you’re being asked to sign.

4. Notify family, friends, financial institutions, social security, health insurance, and other service providers and creditors about your loved one’s death as soon as is practical.

One of the important things you can do after someone dies is to make a concerted effort to notify the appropriate parties. In addition to friends and family, notify financial institutions, insurance carriers, service providers and creditors about the death. This will help those in charge of the estate, and its beneficiaries, police your loved one’s assets and liabilities. Just as it’s a good idea for someone undergoing medical treatment to bring another person along to appointments for help with retaining complex medical information, make sure you either take copious notes or have someone else on the phone or with you in person. That way, the information you receive doesn’t go in one ear and out the other.

5. Defer any major decisions with legal implications (like divorce, prenuptial agreements).

Those first intense weeks and months after a loved one’s death are generally not the right time to make major life decisions, such as initiating, or responding to, a proposed divorce agreement, pre- or post-nuptial agreement, or any written contract related to your marriage or its breakup. If at all possible, don’t enter into contracts during an intense period of grieving. You may later come to regret decisions made during that time. If your spouse is an insensitive [fill in the blank] and initiates a divorce during your period of grief, instruct your lawyer to ask his/her lawyer to back off for a while. Sometimes, this actually works!

If your spouse (or future spouse) will not back off, make sure you hire a trustworthy attorney who understands your state of mind and main objectives, and who can negotiate on your behalf. (But keep in mind: It’s best not to treat your attorney like your therapist; she won’t be as effective in providing emotional support, and her bill is almost sure to be higher.)

6. Keep track of expenses you incur in connection with your loved one’s death.

Many people don’t know that reasonable out-of-pocket expenses incurred with the funeral and other expenses related to the administration of the estate are often reimbursed by the fiduciary of the estate. In some cases, such expenses may also be deductible on tax returns filed in connection with the decedent’s estate. While estates are taxed on the value of your loved one’s assets as of the date of death, estates are also subject to income tax on income earned after the death. If, for example, the decedent owned commercial property, the estate tax return would reflect the date-of-death value but the estate income tax return would reflect the income the estate earned from the commercial property until such property is transferred/sold out of the estate. For these and other reasons, you need to keep accurate records of all expenses. Computer-based accounting applications are helpful in tracking such expenses.

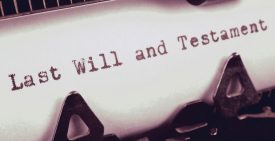

7. Identify the fiduciary of your loved one’s estate.

Related

The laws (which vary state-to-state) governing a decedent’s estate will provide a guideline for the appointment of the individual(s) or, in some cases, institution, to handle the administration of the estate. This person is often named in the decedent’s will. The fiduciary is responsible for investigating the financial and legal status of the estate, preparing relevant court documents and accounting, filing estate tax and estate income tax returns, and distributing the assets to the beneficiaries. The fiduciary also has the authority to retain attorneys, accountants and other professionals. If this makes your head spin, call an attorney ASAP! If you don’t have someone who can refer you to a lawyer experienced in all things related to estates, refer to the American College of Trusts and Estates Counsel.

8. Assemble your professional advisory team (attorney, accountant, financial planner, therapist).

Unfortunately there’s no way to “grieve easy.” But you can lighten your load by assembling the right professional team for your personal situation. Hiring experienced, competent professionals can lift many of your burdens and provide you with the time and opportunity to focus on personal and emotional issues presented by the grieving process.

In addition to a therapist and attorney(s), it’s almost always advisable to have a competent accountant who can field your questions and give financial advice. If you expect to inherit a significant amount of money, or if you already had money but are used to managing it yourself, find a trustworthy financial advisor to step in and help you at a time when you’re distracted and not in the best frame of mind to make financial decisions.

There are also companies who offer “soup to nuts” bereavement services. This could be particularly helpful if your deceased relative lives out of state. Bereavement Concierge Services, for example, is a company that helps with a wide range of services related to this process — from cleaning out your relative’s home, to writing thank you notes, to helping you right legal and financial professionals.

Seek referrals from your attorneys or close family or friends who you trust, if you need to find a new accountant or financial advisor. We do not suggest a random Internet search; now is not the time for you to spend energy interviewing complete strangers from Google Ads.

9. Uncover the implications of what (or who) you may inherit.

You may inherit money, real estate, debt or some combination of all of those. Were you gifted property alone, or were you gifted in conjunction with your spouse? Are you and your siblings inheriting property jointly? Have you become a guardian to children who were not previously yours? What do these scenarios mean? Are there tax implications to what (or who) you will be inheriting? With the right team of professionals, all these questions can be easily answered.

10. Prepare to see the best and/or worst in people.

This piece of advice is like telling someone their life will be turned upside down when they have a baby. It’s so true, yet impossible to fathom until it happens to you. Some people will show up knowing exactly what to do and say to help you. Others will freeze up, disappear or surprise you in the worst ways. Find comfort and commiseration from similarly situated individuals (like those on this very site).